A new report from Singapore-based fintech firm ROSHI has raised alarms about the growing credit card debt crisis in the Philippines, with consumer debt reaching levels described as “critical.”

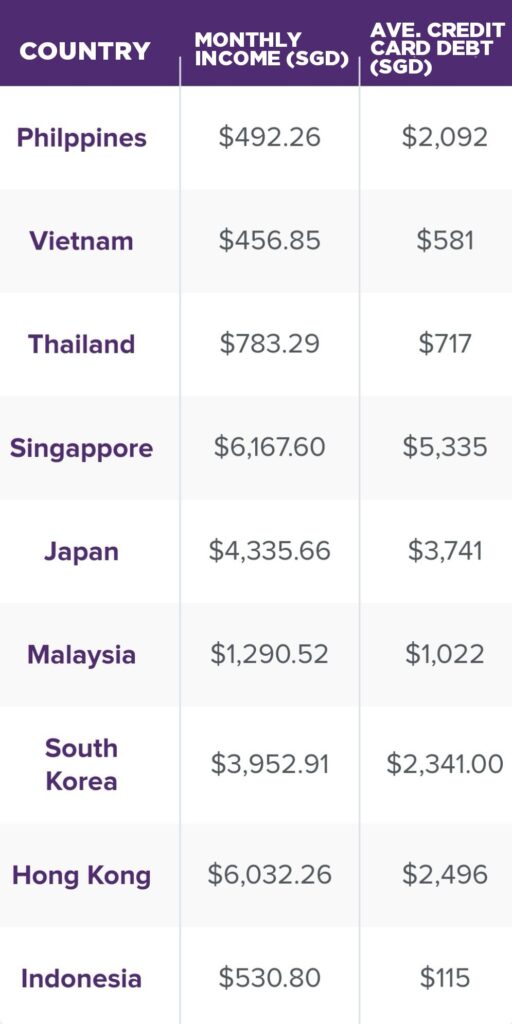

According to the findings, Filipino cardholders are carrying an average balance of S$2,092, while the typical monthly income is just S$492.26. This results in a staggering debt-to-income ratio of more than 425%, far exceeding the regional average and highlighting a concerning trend of financial vulnerability.

ROSHI’s chief executive Amir Nada noted that this situation is unsustainable for many consumers. According to Nada, credit card debt levels in the Philippines have reached a point where they pose a significant risk to financial stability. With an average credit card balance more than four times their monthly income, Filipino consumers are walking a precarious line between borrowing and financial collapse.

This widening gap between debt and income is exacerbated by limited access to affordable credit solutions. While financial inclusion has made significant strides in other Southeast Asian countries, many Filipinos remain dependent on high-interest credit cards, with few viable alternatives. The lack of affordable credit options, combined with low financial literacy, forces consumers into a cycle of borrowing from expensive sources without understanding the long-term consequences.

The problem is further compounded by the region’s rising interest rate environment. With credit card interest rates hovering between 25% and 29%, Filipino consumers face mounting costs on outstanding balances. This makes it increasingly difficult for many cardholders to break free from the debt cycle.

As the debt burden grows, the risk of defaults also increases, raising concerns about potential instability in the country’s financial sector. Widespread defaults could erode consumer confidence and weaken the financial system, affecting both individuals and institutions. For the Philippines, where credit card debt is already at crisis levels, the situation demands urgent attention.

Comparatively, other countries in the region present a mixed picture of credit card debt levels. Singapore has the highest average credit card balance in Southeast Asia at S$5,335, which represents 86% of the average monthly income of S$6,167.60. Hong Kong follows closely with an average debt of S$2,496 against an average monthly income of S$6,032.26. Japan’s credit card debt averages S$3,741, with a monthly income of S$4,335.66. Vietnam’s credit card debt is comparatively lower at S$581, yet its financial system is rapidly modernizing, with credit card circulation growing 2.4 times from 2018 to mid-2023.

On the other end of the spectrum, Indonesia records the lowest average credit card debt at just S$148, reflective of its predominantly cash-based economy and lower credit card penetration. The average monthly income in Indonesia stands at S$530.80. Malaysia, Thailand, and South Korea have more moderate debt levels, with South Korea’s average credit card debt at S$2,341, while Malaysia and Thailand are closer to the regional mean.

ROSHI is calling for greater financial literacy and improved access to affordable credit options. Consumers need better tools and guidance to manage their debt responsibly, as well as more regulatory measures to protect them from predatory lending practices.

The report paints a stark picture for the Philippines, where the rising levels of credit card debt threaten both individual financial well-being and broader economic stability. ROSHI’s analysis underscores the urgent need for proactive action from both consumers and financial institutions to address the country’s growing debt burden.

With credit card debt levels reaching crisis proportions, it is imperative for both consumers and financial institutions to take a more proactive stance on managing debt and ensuring long-term financial stability, Nada concluded.