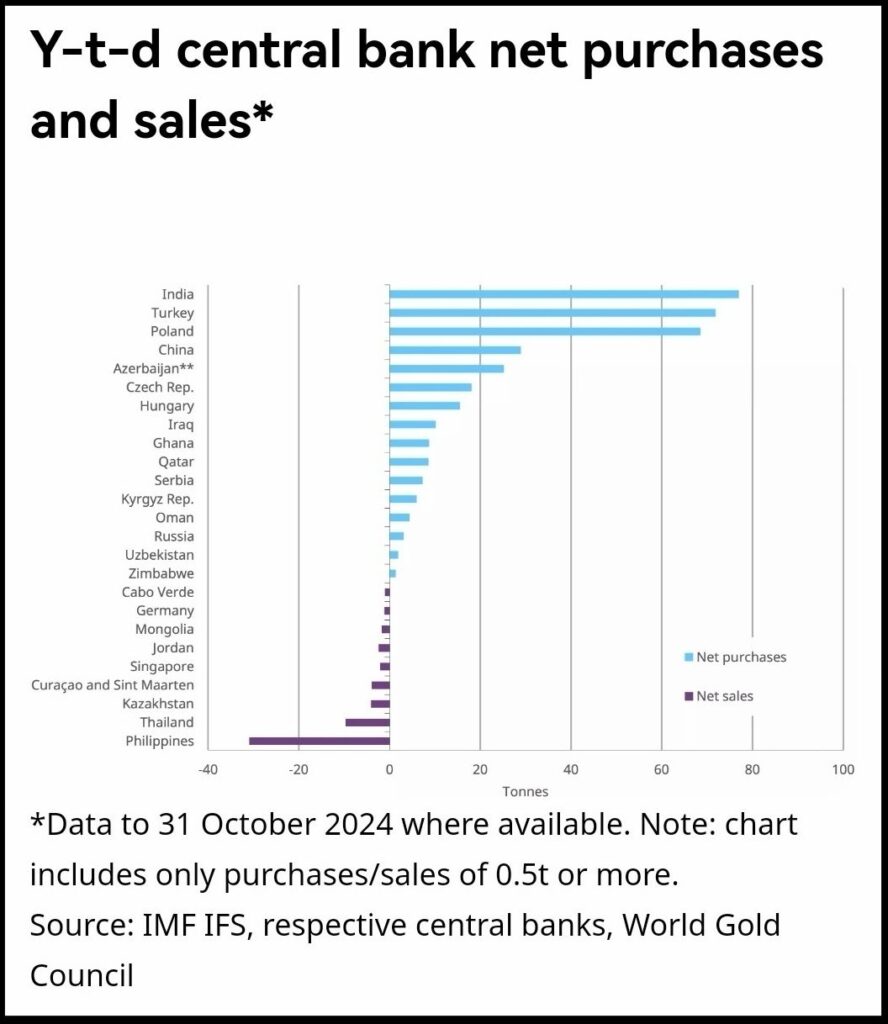

Global central banks recorded net gold purchases of 60 tons in October, the highest monthly total in 2024, according to the latest data from the World Gold Council (WGC). The surge in buying was led by India, Turkey, and Poland.

In contrast, the Philippines emerged as a significant seller during the period, offloading approximately 5 tons of gold since the end of the first half, bringing its year-to-date sales to around 30 tons, according to WGC data. This reflects a continuation of the selling trend observed earlier this year.

Notably, during the first half of 2024, the Bangko Sentral ng Pilipinas (BSP) led global gold sales, reducing its gold holdings by 24.95 tons to 134.06 tons.

The BSP defended its sales, describing them as part of an “active management strategy” for the country’s gold reserves, which form a critical component of the Gross International Reserves (GIR). It emphasized that the sales capitalized on higher gold prices to generate additional income, all while maintaining the reserves’ insurance and safety objectives.

Despite the gold sales, the Philippines’ GIR remained strong, climbing to $112.43 billion by the end of October 2024, up from $103.8 billion in December 2023. The reserves are sufficient to cover 8.1 months of imports and payments for services and primary income, and they are about 4.5 times the country’s short-term external debt based on residual maturity.

Meanwhile, the value of gold held by the BSP rose by 4.6% to $11.35 billion, as international gold prices stayed elevated due to safe-haven demand amid global geopolitical tensions and recent developments in the United States, including the elections.