Asia Pacific’s real estate markets are holding firm despite global economic turbulence triggered by aggressive policy shifts from Washington. The region, including the Philippines, is proving resilient, as Cushman & Wakefield’s latest report outlines, buoyed by structural strengths, digital infrastructure growth, and strategic supply chain shifts.

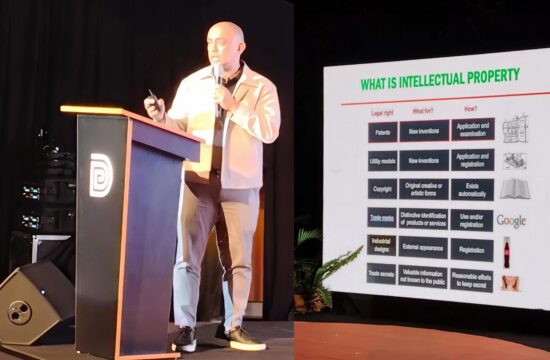

In a Manila briefing titled “The 2025 Triad: Trump’s Return, ASEAN’s Rise and the Philippine Property Path,” the global real estate services firm unpacked the early impact of U.S. President Donald Trump’s second-term policy changes on Asia-Pacific investment sentiment. Tariff hikes, deregulation, and a sharpened U.S. trade stance have introduced volatility, but haven’t derailed Asia Pacific’s long-term momentum.

“Uncertainty has been the dominant theme of the first 100 days,” said Dr. Dominic Brown, head of international research at Cushman & Wakefield. “While periods of heightened uncertainty typically dampen business and investment confidence, Asia Pacific’s strong fundamentals are helping to cushion the impact.”

According to Cushman & Wakefield’s research, the region continues to benefit from its long-term fundamentals: robust consumption, demographic strength, and policy frameworks that support economic diversification. With the region projected to outpace the combined economic output of the U.S. and Europe by 2050 and generate 75 million new jobs over the next two decades, investor interest remains strong even amid global headwinds.

The report also notes that industrial hubs across Southeast Asia are well-positioned to absorb trade disruptions. Ongoing supply chain diversification continues to redirect investment to the region, with industrial and logistics assets moving ahead of traditional office and retail plays. Investment in data centers, in particular, has surged—reaching $3.2 billion in 2024, more than four times the previous year and comprising 40% of total industrial sales across Southeast Asia. Singapore, Malaysia, and Indonesia lead this shift, propelled by digital demand, cloud adoption, and supportive regulation.

“Despite the uncertainties in the global landscape due to the evolving tariff situation, Southeast Asia’s economic fundamentals remain steady, with resilient domestic consumption and a growing middle class,” said Xian Yang Wong, head of research, Singapore & Southeast Asia at Cushman & Wakefield. “Industrial and data centers will remain top priorities for institutional investors, with increasing capital allocated to logistics, life sciences, and AI-driven digital infrastructure.”

Philippine property holds steady amid global jitters

In the Philippines, the property sector held steady in the first quarter of 2025. Cushman & Wakefield’s Q1 2025 MarketBeat reports show that while the vacancy rate for Prime and Grade ‘A’ office space in Metro Manila inched up to 17.3%—driven largely by the exit of Philippine offshore gaming operators (POGOs) and an influx of new supply—leasing activity remains supported by the continued expansion of the information technology and business process management (IT-BPM) sector.

Tetet Castro, director and head of the tenant advisory group at Cushman & Wakefield, cited consolidation and expansion within the IT-BPM industry as stabilizing forces in an otherwise subdued office landscape. Average headline rents declined slightly to P987 per square meter per month, with further pressure anticipated for non-core developments amid persistent oversupply.

Elsewhere in the market, outlooks vary. The mid-end residential segment continues to face headwinds from elevated interest rates, foreign investor retreat, and a growing inventory overhang. Roughly 15% of the 450,000 mid- to high-end units in Metro Manila remain unsold—equivalent to five to six years of supply at current absorption levels. However, this presents opportunities for local investors, who may find better deals or acquire undervalued assets in a quieter market. Meanwhile, the high-end residential segment, less affected by financing constraints, shows continued capital value resilience.

Retail and hospitality assets are adapting to changing consumer habits and the return of travel. Global trade tensions have softened international retail sentiment, but localized demand—particularly in emerging provincial urban centers—is supporting stable foot traffic and spending. The hotel sector is also regaining momentum, buoyed by the return of corporate events and international tourism.

Industrial and logistics properties remain the most in-demand, driven by e-commerce growth and structural shifts in global supply chains. Still, Cushman & Wakefield warns that geopolitical tensions and rapid technological change could inject future volatility into this sector.

Claro Cordero, director and head of research, consulting & advisory services at Cushman & Wakefield, emphasized that developers and investors must remain vigilant as macroeconomic risks—from inflation to currency fluctuations—continue to weigh on market stability. Disrupted supply chains are also straining construction timelines and elevating project costs.

Yet amid these pressures, new opportunities are emerging. Demand is rising for sustainable, energy-efficient developments and tech-enabled real estate solutions as global capital increasingly prioritizes environmental, social, and governance (ESG) standards and digital transformation.

“The Philippine real estate market reflects nuanced sectoral trends shaped by global economic headwinds and shifting investor behavior,” said Cordero. “Philippine developers and investors must strategically position themselves to cater to increasing demand for energy-efficient buildings and smart infrastructure expected to rise alongside consumer spending.”

These evolving priorities present both competitive pressures and growth avenues. While forward-looking strategies focused on sustainability and digitalization may unlock long-term value, they must be weighed against persistent macroeconomic challenges that continue to shape investment decisions.

“Despite these opportunities, macroeconomic risks such as rising inflation and currency fluctuations remain significant factors for Philippine real estate investors. Developers must also remain alert to disrupted supply chains, which directly affect project timelines and construction costs,” Cordero added.