The Philippine economy expanded 5.4% year-on-year in the first quarter of 2025, underperforming the government’s 6% to 8% growth target and signaling deeper structural issues that continue to constrain the country’s long-term economic potential, according to the latest report from De La Salle University’s Angelo King Institute for Economic and Business Studies.

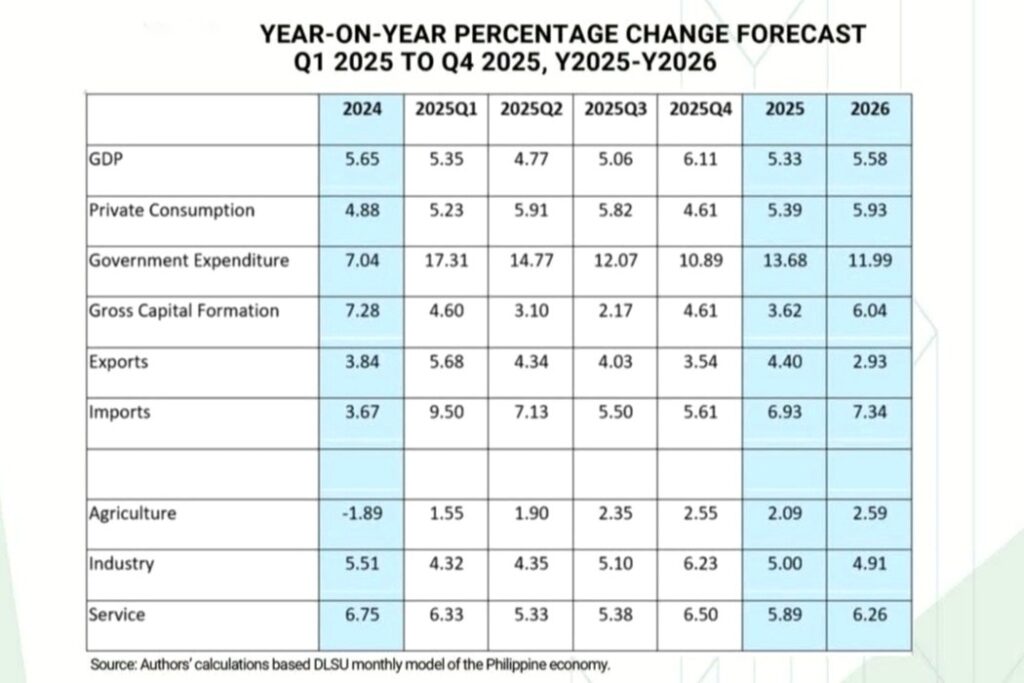

The report, anchored on forecasts from DLSU’s Philippine High Frequency Model, revised its full-year 2025 GDP growth estimate to 5.33%, down from its April projection of 5.8%. Growth is expected to dip further to 4.77% in the second quarter before rebounding to 6.11% in the fourth quarter—closer to the economy’s potential, though still shy of the government’s ambitious targets.

Domestic demand remains the primary growth driver. Private consumption is projected to rise 5.91% in the second quarter (Q2), while public expenditure is forecast to surge 14.77%, even as it gradually decelerates toward the year-end. Gross capital formation is expected to slow to 3.1% in Q2 but average 4.92% in 2025.

Trade figures continue to raise concern. Exports are forecast to grow by 4.34% in Q2 and finish the year at 4.4%, reflecting the impact of rising global trade friction. Imports, meanwhile, are expected to outpace exports with 7.13% growth in Q2 and a 6.93% full-year average—further widening the trade deficit.

Sectorally, Services and Industry are expected to post robust growth of 5.89% and 5%, respectively, while Agriculture lags with a projected 2.09% uptick. The strong domestic activity is bolstered by easing inflation—now at a five-year low of 1.4%—and pre-election spending, giving the Bangko Sentral ng Pilipinas (BSP) room to consider rate cuts.

BSP Governor Eli Remolona has signaled a possible rate cut by year-end, citing soft inflation and slowing growth. Easing monetary policy, the report says, will help sustain private consumption, stimulate investment, and enhance capital formation.

Short-term gains, long-term warnings

Despite the near-term fiscal boost, DLSU economists warned that public infrastructure spending alone won’t secure sustainable growth. The report stresses that without meaningful economic transformation—particularly industrial deepening—actual growth will remain capped by the economy’s structural limitations.

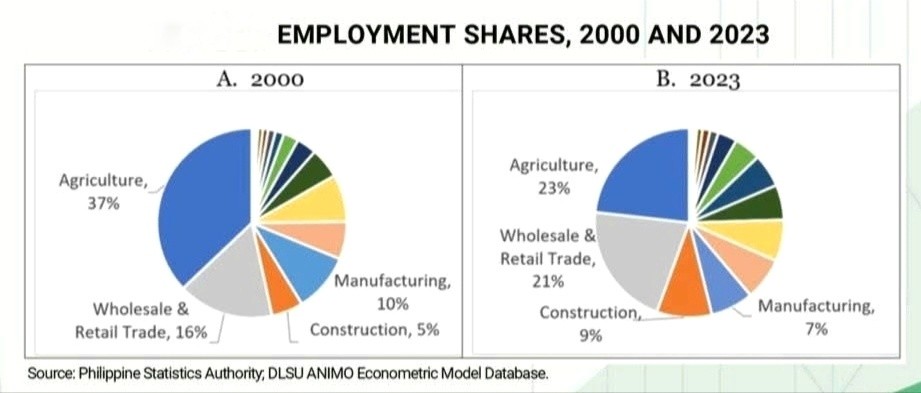

“We lag behind those of our neighbors because to the pace and direction of the transformation of the economy,” the report stated, noting that the Philippines is shifting towards low-productivity sectors such as wholesale, retail trade, and construction, which collectively employ over half the labor force.

The employment share in agriculture declined from 37% in 2000 to 23% in 2023, yet productivity and wages in the sector remain among the lowest. Meanwhile, manufacturing—a high-potential sector—accounts for only 7% of total employment, a decline in relative share despite a modest increase in headcount.

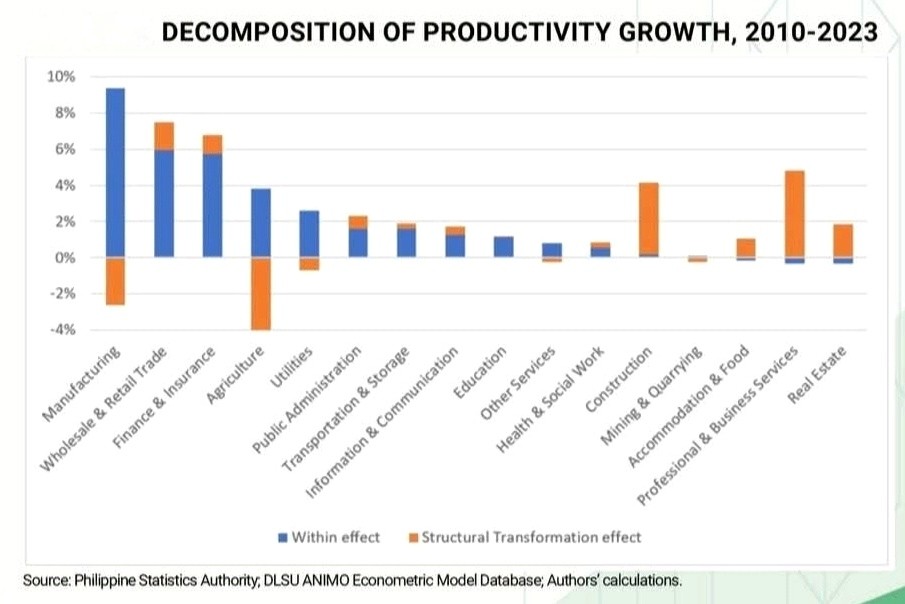

The report decomposes aggregate productivity growth between 2010 and 2023 and finds that structural transformation—i.e., the movement of labor into more productive sectors—has made a limited contribution. The 41% productivity increase over 13 years (2.7% annually) came largely from within-sector gains in manufacturing, trade, and finance, while agriculture and mining contributed nothing or negatively.

Economic transformation contributes to growth—not the other way around, the authors argue. Without shifting labor into higher-value sectors, long-term productivity and wage growth will remain elusive.

A call for industrial policy

The study takes aim at the country’s long-standing aversion to industrial policy. “There is no single relevant example of a nation that reached high income (status) without industrialization and without government intervention,” the report warns, criticizing tax incentives and infrastructure spending as insufficient for transformation.

Manufacturing, productivity, exports, and firm capability building—these are the levers for real economic transformation, according to the report, noting that higher real wages are only possible through specialization in high-value activities.

While the private sector is the engine of job creation, most new employment is in low-productivity occupations—delivery riders, sales staff, waiters—offering little scope for upward mobility. High-value service sectors like BPOs and finance, although offering better pay, employ a small fraction of the workforce and cannot be relied upon for mass employment.

Policy implications and risks

Budget Secretary Amenah Pangandaman acknowledged the underwhelming first-quarter results but remained optimistic, citing broad-based sectoral growth. She emphasized the role of public spending in cushioning the economy against global headwinds, including U.S. trade policy shifts, China’s slowdown, and geopolitical instability.

The DLSU team agreed on the importance of fiscal stimulus but cautioned that it must be directed toward long-term transformation, not just short-run support.

“While the Philippine government continues to highlight the role of infrastructure spending in the country’s short-run growth, investment in more roads (alone) will not do it,” the report emphasized.

With the International Monetary Fund (IMF) forecasting global growth at just 2.8% for 2025 and the ongoing U.S.-China tariff war clouding the outlook, the Philippines is unlikely to achieve sustained 6% to 8% growth without structural change. While recent negotiations between the U.S. and China suggest easing tensions, the report urges caution, stating that the Philippine economy remains vulnerable to external shocks due to its limited trade exposure but weak internal transformation.

Bottom line

Even under the best scenarios, the report concludes, Philippine growth will likely hover around 6%—the economy’s true potential unless the government confronts its structural bottlenecks.

“We are less optimistic than the government,” the DLSU team wrote. “Not because we think that the economy is not moving forward, but because the government has set targets that are out of our economy’s reach.”

Achieving 8% growth consistently requires more than optimism—it requires a transformed economic base, the DLSU team concluded.