When news broke that Philippine exports would face a 19% tariff entering the United States—while American goods would enter the Philippines tariff-free—it was met with understandable frustration. Social media buzzed with disbelief: “Bakit ganun? Lugi tayo ah.” For many Filipinos, the optics were clear—unequal and unfair.

From business groups to small exporters and everyday workers, the reaction ranged from concern to indignation. Was this a diplomatic blunder, a strategic oversight, or simply the cost of doing business with a superpower?

Under the new trade arrangement announced during President Ferdinand Marcos Jr.’s working visit to Washington, the Philippines finds itself navigating an uneven deal. Though now enjoying the second-lowest tariff rate among Southeast Asian exporters to the U.S.—next to Singapore’s 10%, thanks to a long-standing Free Trade Agreement—the 19% rate is still a burden for the Philippines.

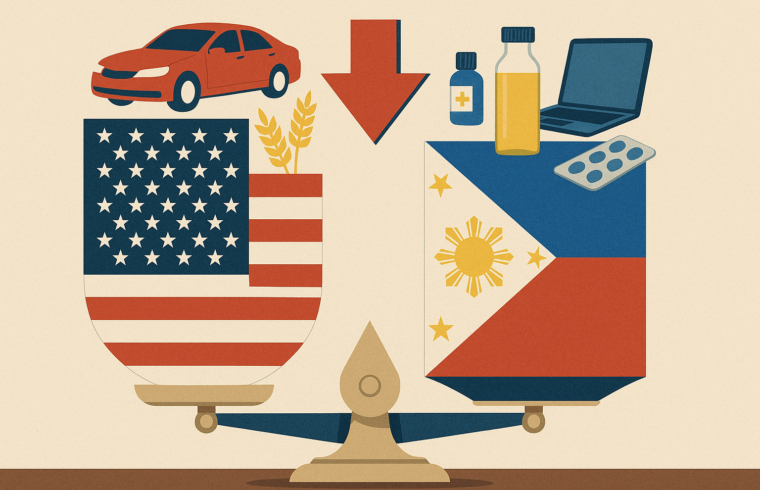

But facts offer a more layered view. According to the Office of the U.S. Trade Representative, total bilateral goods trade between the U.S. and the Philippines reached $23.5 billion in 2024. Of that, $14.2 billion were Philippine exports—mostly electronics, agricultural products, and processed foods. In return, the U.S. exported $9.3 billion worth of goods to the Philippines, including vehicles, medicine, and grain. This left Washington with a $4.9 billion trade deficit with Manila, a 21.8% jump from 2023.

This imbalance is what critics fear could soon shift. With Philippine exports now priced higher in the U.S. due to the tariff, demand could decline. The U.S. trade deficit might narrow—not because of greater U.S. competitiveness, but because Filipino goods become less affordable.

At first glance, it looks like Washington just played Manila at its own expense. And while the terms appear lopsided, the moment still offers opportunity—if the Philippines is willing to pivot from passive participant to strategic actor. Tariff-free access to U.S. products, controversial as it may be, could become a springboard for long-needed reforms, particularly in agriculture and healthcare.

For one, increased availability of U.S. agri-tech could fuel a quiet revolution in farming. A targeted P11 billion investment in cold storage systems, solar-powered irrigation, and AI-driven crop forecasting—sourced from American suppliers now entering tariff-free—could increase productivity and raise incomes by at least 20% for 200,000 coconut farmers. That’s an extra P2 billion in rural revenue.

On the export side, Filipino products still have a chance to compete—if repositioned as premium. A 1-liter bottle of Philippine coconut oil exported at $5 would retail in the U.S. for around $6.45 after tariffs and shipping. That’s still cheaper than many organic alternatives on American shelves. If even 100,000 units are sold annually, that’s $645,000 in retail value. With just a 15% margin, small producers could collectively earn nearly P5.5 million a year—supporting dozens of rural co-ops.

Medicine, too, could become more affordable. With U.S. pharmaceuticals entering the country duty-free, the Philippine government could negotiate better bulk prices. Based on average household spending, even a modest 3% drop in medicine prices—made possible by increased pharmaceutical imports—could save Filipino families up to P1.5 billion annually—freeing money for food, tuition, or small business capital.

And then there’s the services sector, our silent economic engine. The Philippines remains one of the world’s top BPO destinations, and American firms are our biggest clients. With the right tax incentives or tourism privileges, the country could attract more U.S. businesses and tourists. Just 50,000 additional American visitors spending $1,200 each would inject $60 million into the local economy.

Another underutilized asset is the Filipino-American diaspora, which totals nearly 4.4 million people, according to the U.S. Census Bureau’s 2023 American Community Survey. Even a modest shift in their buying power—toward rebranded, high-value Philippine exports like coconut oil, mango products, or artisanal textiles—could create ripple effects across domestic supply chains.

A forward-looking initiative, building on the government’s existing Tatak Pinoy program, could actively promote these products in major U.S. retail channels. By mobilizing diaspora networks, supporting Filipino-American entrepreneurs, and engaging with retailers like Trader Joe’s, Whole Foods, or Costco, the Philippines could secure not just brand visibility but lasting shelf presence. The effort wouldn’t need to be massive; strategic placement of select products could generate multiplier effects for small exporters and rural communities alike.

Of course, transparency remains essential. The full text of the agreement has yet to be released, and Filipinos deserve to know what was signed in their name. But while public scrutiny is essential, so is strategic thinking.

There’s precedent for turning asymmetry into advantage. In the 1990s, South Korea accepted unfavorable trade conditions to gain WTO access. It wasn’t about the tariffs—it was about the long game. Over the next two decades, it built global champions like Samsung and Hyundai and turned its economy into one of Asia’s strongest.

The Philippines may not replicate Korea’s rise, but we can borrow its playbook: see beyond the short-term sting, and build long-term strength. Trade isn’t a scoreboard of winners and losers. It’s a chessboard. And the next moves matter most.

A 19% tariff may hurt today, but if it jolts the country into investing in its farmers, supporting its exporters, and activating its diaspora, it may well become the opening move in a more competitive future.