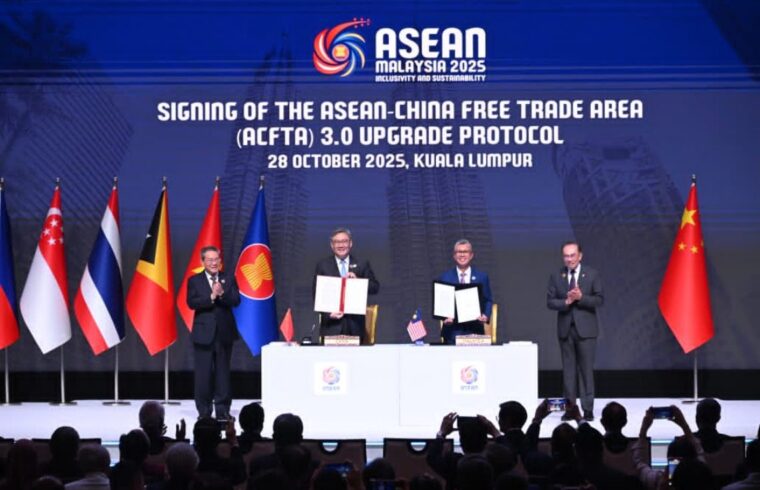

While much of the world leans toward protectionism, Asia is quietly redrawing its trade map. The newly signed ASEAN-China Free Trade Area 3.0 Upgrade Protocol—sealed in Kuala Lumpur on October 28—signals how the region plans to keep growth alive even as global walls go up. For the Philippines, this isn’t just another acronym in the alphabet soup of trade deals. It’s a chance to modernize, digitize, and anchor its economy to Asia’s fastest-growing network.

The first ASEAN-China Free Trade Area (ACFTA), launched in 2010, was already vast. Its 2019 upgrade deepened tariff cuts and investment rules. Version 3.0 goes further—adding digital trade, green economy, agriculture, and pharmaceuticals to the mix. For a developing country still tethered to electronics exports, it’s an opening to finally diversify — and to do so in the sectors defining the future.

The timing couldn’t be more strategic. With Washington tightening tariffs and global demand stalling, China and the Association of Southeast Asian Nations (ASEAN) are doubling down on each other. “China and ASEAN, hit by U.S. tariffs, are binding closer together to shield their markets,” experts noted. Chinese exports to ASEAN jumped 22.5% in August alone, proof that Southeast Asia is now China’s lifeline. The Philippines can ride that current if it plays its cards right.

Digital trade is where the action lies. The 3.0 upgrade strengthens both physical links — fiber optics, data centers — and regulatory ones, through unified rules on payments, data flows, and consumer protection. “The Version 3.0 upgrade will bring our economic cooperation to a height, particularly in new areas, e-commerce, digital trade and payment,” said ASEAN secretary-general Kao Kim Hourn. For a country with one of the world’s most connected young populations, this could be transformative. Filipino MSMEs already use platforms like TikTok Shop and Shopee to reach buyers abroad; under ACFTA 3.0, they can scale faster, with fewer cross-border barriers.

The green economy clause may be the deal’s quiet powerhouse. It encourages investment in renewable energy, sustainable logistics, and low-carbon industries—critical for an archipelago battered by climate risks. By aligning with these priorities, the Philippines could attract capital for solar manufacturing and clean-tech infrastructure, giving substance to its “Build, Better, More” mantra.

Beyond new sectors, the upgrade promises smoother trade. Simplified customs procedures, mutual inspection recognition, and streamlined certification mean fewer bureaucratic choke points. “Both sides aim to build a unified and modern regulatory framework to reduce non-tariff barriers and promote deeper integration,” said Li Guanghui of Guangxi University’s China-ASEAN School of Economics. In a country where it can still take days to clear exports through ports, these rules could save Philippine firms time, money, and patience.

For micro, small, and medium enterprises (MSMEs)—the backbone of the Philippine economy, making up 99.5% of businesses and 63% of jobs—this is more than procedural. It’s existential.

Liu Qing of the China Institute of International Studies said the new framework particularly addresses the needs of MSMEs from both sides, enhancing the resilience and stability of regional industrial and supply chains. If properly leveraged, it could finally allow Filipino entrepreneurs to compete in e-commerce and niche manufacturing beyond domestic shores.

The regional momentum is undeniable. China-ASEAN trade hit US$785 billion in the first nine months of 2025, up 9.6% from a year earlier and accounting for about 16% of China’s total trade. For 16 straight years, China has been ASEAN’s main trading partner, and ASEAN has been China’s largest for the past five. Philippine exports to China reached US$9.4 billion in 2024. If barriers keep falling, that number could soon climb—especially in agriculture, processed food, and creative goods.

Still, none of these gains will happen on autopilot. The Philippines must get its house in order—modernize logistics, overhaul costly port systems, curb corruption in infrastructure projects, and align domestic regulations with regional standards. MSME support can’t stop at rhetoric. Financing, training, and export-readiness programs must be scaled up, or the small players that make up the country’s economic base will miss the wave entirely.

President Ferdinand Marcos Jr., who witnessed the signing in Kuala Lumpur, seemed aware of both the promise and the challenge. “We welcome the just-concluded signing of the [ACFTA 3.0 Upgrade Protocol] and hope that this will enable us to modernize trade practices and effectively respond to emerging economic challenges,” he said. His words echo a broader truth: the deal gives the Philippines a framework for modernization—but not a guarantee.

That caution matters. Deeper trade with China must coexist with a clear assertion of national interest, especially amid maritime tensions. In an intervention at the 28th ASEAN-China Summit, Marcos stressed that “this cooperation cannot exist alongside coercion.” He added that partnerships must be rooted in “mutual respect for sovereign, equality, and adherence to international law as guiding principles.”

On the other hand, Malacañang described the deal as a reflection of “the shared commitment of ASEAN and China to deepen regional integration and promote sustainable and inclusive growth across the region.”

The long-term implications for the Philippines could be transformative. Integration into a region that collectively represents one-third of global GDP will demand competitiveness, not complacency. It will require upgrading logistics, investing in skills for the digital economy, and harmonizing domestic regulations with regional standards. But if managed well, the dividends could be enormous—from increased export diversification to stronger investor confidence and job creation in new industries.

The ACFTA 3.0 upgrade offers more than market access; it offers momentum. For the Philippines, its true test lies not in the signing but in the doing—in building real, not ghost, infrastructure; in nurturing talent; and in aligning trust with trade. This is a make-or-break moment for a country seeking relevance in a shifting regional order. The region is moving fast. The question is whether the country will keep pace or fall behind.